For trade I recommend to choose any Forex Broker Rating >>

Harmonic price patterns, there are several, but today we look at one of the most common of them - the "Butterfly Pattern" (buy - bullish and bearish for sale).

This strategy, you most likely have repeatedly met on the Internet, but a detailed description on the entry into the market, as well as how to still work with this model explains none. Today I will try to fill this gap and I just explain why, in this model it is necessary to pay more attention.

Gartley Model "Butterfly" - is a very good model and usually give a fairly good entry point into the market (something this model can be confused spatternom Flag), but it has its own laws and more in market entry conditions.

And so, let's look at how to accurately identify and enter into forex "Butterfly Effect" market strategy:

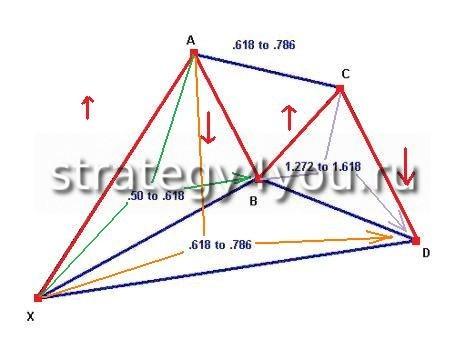

Butterfly Gartley forex

in the picture above you can see Bull Gartley pattern "Butterfly" (ie, the transaction will be concluded on the purchase)

1) The red lines marked sections of the price movement on the chart of any currency pair:

Point X - the starting point, the starting point of the harmonic pattern "Butterfly"

The XA - impulse upward price movement on the chart (it is PULSE instead of sideways movement - that movement which is directed in one direction, and without strong setbacks - the movement as "a breeze"), which we take as a basis, and stretch for him Fibonacci levels (build in the course of price movements from bottom to top)

AB - corrective price movement from point X to point A, while point B should be in the range of 50% to 61.8% Fibonacci (desirable but not a requirement, even if the price is around this level - is also very good, but if the price is still reached the level of 50% Fibonacci and rebounded from it - it is a good sign)

Sun - the upward movement in the model Butterfly (directed in the same direction as the length of the XA), while point C should be located at a distance of 61.8% and 78.6% Fibonacci constructed on the segment from point A to point B

CD - 2nd correctional movement down the price for a segment XA, and it can be 1.272 - 1.618 times the length of the sun!

The point D - point of the deal to buy (on the model of Hartley "Butterfly") may be in the range from 61.8% to 0,78,6% Fibonacci.

2) Therefore, we have a vicious cycle of price builds, and if some do not match the ratio in this model, the bargain simply is not. And we pay close attention to the last point is the construction of D and to this point and set a pending order to buy - Buy Limit. More precisely to the point podhoditimenno level of 61.8% Fibonacci of XA, or extension of 1.618% of the sun, can also be a point of contact with the channel, and the like (podrobneesmotrite the deal at the pattern flag)

And here is an example of classic Bullish Butterfly on the currency pair USDCAD (M5):

There is also a 2nd entry option in the market - a more conservative (but then the entrance to the stop-loss market is a bit more than when trading on the Buy Limit-in, but you will definitely see you go to the market or not - because point D will be formed completely and you can check out all the Fibonacci ratios, and only then place an order on breakdown - Buy Stop)

Buy stop order is set for the breakdown of the trend line, built from the maxima of the segment CD or enter the market at the market price after closing the candle above the trend line built (as in the forex strategy trend lines - not only on the rebound, and breakdown)

3) Because we got an entry point into the market, the next step is to determine where to place the stop-loss. A stop-loss, I recommend setting a few points below the level of 78.6% Fibonacci

4) Where to place take-profit - you decide, again, you can use the Fibonacci extension to determine tochev exit from the market, to establish the open position of a trailing stop (or rearrange the position to breakeven, when a certain you count of pips) use important levels to exit a position. But I believe that the first target for the profit (or portion of the profits) - A point (that it is possible to set take profit, or close the first part of the profit - for example 30% -50% of the open transaction).

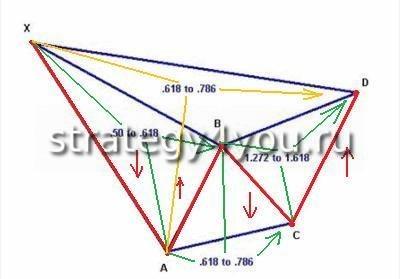

For transactions on sale - check the conditions (and correspondingly the reverse pattern "Butterfly" - bear)!

An example of a deal to sell for "Bear Butterfly" model, the currency pair USDCHF (H1):

NOTE: The ideal bullish and bearish harmonic pattern "Butterflies" is not so often appear in the forex market, but if you notice them and they will comply with all the terms of the transaction - safely open trading position, since the probability of profit is very high! But, at the same time, in any case, we should not forget about money management Forex !!!

Indicators and Forex Metatrader 4 templates in the forex strategy is not used, so I do not spread them.

So I recommend to view the video version of forex strategy "The Butterfly Effect", in which I was seated on how to accurately identify the "Butterfly" model examples and point out the basic errors in their identification!