I recommend selecting a Broker in FOREX RATING terminal Metatrader 4.

Explain the Forex Day Open Fibo strategy Example:

Suppose that the opening day of the pair GBPUSD 1.6447

To determine critical levels calculated using the static Fibonacci -Add these numbers and subtract them from the opening of the market price on that day:

We get the following levels:

HL1 = 1.6447 + 0.0034 = 1.6481

HL2 = 1.6447 + 0.0089 = 1.6536

HL3 = 1.6447 + 0.0144 = 1.6591

HL4 = 1.6447 + 0.0233 = 1.6680

HL5 = 1.6447 - 0.0034 = 1.6413

HL6 = 1.6447 - 0.0089 = 1.6358

HL7 = 1.6447 - 0.0144 = 1.6303

HL8 = 1.6447 - 0.0233 = 1.6214

Indicator Forex DayOpenFib.mq4, calculates and draws the data levels on the chart, it is necessary to impose on the graph 2 times:

First time set the up = true (building levels above the opening price)

The second time - up = false (building levels below the opening price).

For ease of installation can download Metatrader 4 forex template for this strategy, along with an indicator at the end of the strategy.

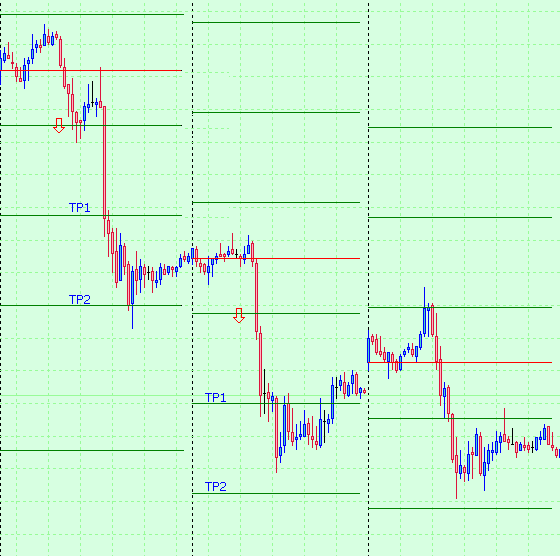

Forex Strategy Day Open Fibo

To enter the market, you need to install 3 pending orders to buy and 3 sell orders pending, after the opening of the new trading day:

1) Set 3 orders Buy Stop lots equal to HL1 level strahovochnyystop-loss is placed at the level of the opening of the trading day (red line).

profit objectives of the following: TP1 = HL2, TP2 = HL3, TP3 = HL4.

2) Install 3 Sell Stop order to HL5 level, a safety stop-loss is placed at the level of opening of the trading day (red line).

profit objectives of the following: TP1 = HL6, TP2 = HL7, TP3 = HL8.

3) If the first load pending order Buy Stop There are 2 options:

a) transfer the Sell Stop order at the level of the opening of the trading day, and the levels of profit-loss istopit shifted one SL = HL1, TP1 = HL5, TP2 = HL6, TP3 = HL7. The converse is true for the case when the first load Sell Stop order.

Once achieved the goal of profit TP1, reinstall the remaining 2 orders to breakeven. Once the objective of the TP2 - reposition the stop-loss order at TP1.

b) transfer the Sell Stop order at the level of the opening of the trading day, and the stop-loss order SL = HL1. A 3 profit targets are now taking the first level of profit, ie, TP1 = TP2 = TP3 = HL5

Additional conditions:

Optionally, at first triggered a pending order of the day - set the trailing stop at 3 orders magnitude of 40-45 points.

Does not work orders are deleted at the end of the trading day.

If at the end of the day were not closed orders - they should be closed at the market price.

Based on their test last month - September 2009 (1 to 18 numbers inclusive) profit amounted to:

case «a)» - about 1400 pips! - A risky way to trade.

case "b)" - over 1200 pips! - A more conservative way to trade.